Explain the Different Financial Institutions and Their Services in India

Commercial banks are one of the major financial institutions. The State level institutions comprise State Financial Corporations SFCs and State Industrial Development Corporations SIDCs.

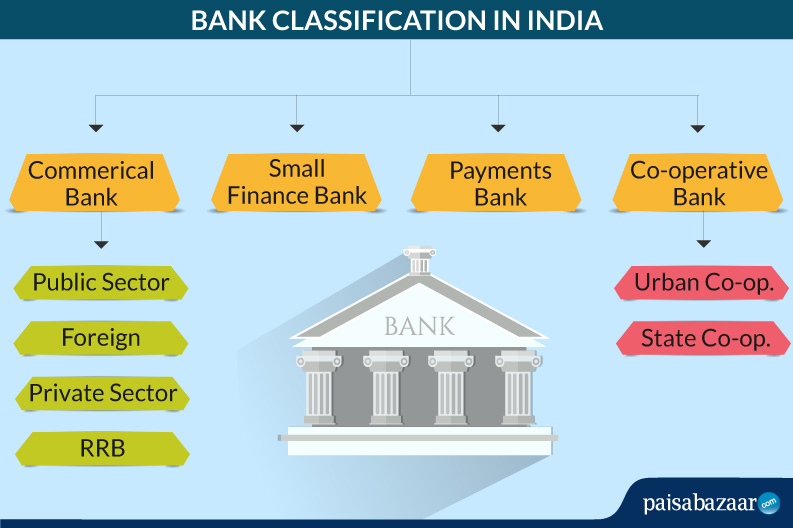

Banking In India Types Of Banks Banking Classification Paisabazaar

General Insurance Corporation GIC 6.

. The market regulator in the Indian capital market is the Securities and Exchange Board of India SEBI. Read more services to their clients. Securities and Exchange Board of India SEBI The Securities and Exchange Board of India SEBI is a statutory body established under the SEBI act of 1992 as a response to prevent malpractices in the capital markets that were negatively impacting people.

Unit Trust of India 7. Credit oriented financial service. Mutual funds are managed by professionals and they charge annual fees for their service.

This type of financial service helps people to save money intelligently and receive a return on their investment when possible. Example PNB SBI HDFC BOB Axis Bank. The Financial Institutions in India mainly comprises of the Central Bank which is better known as the Reserve Bank of India the commercial banks the credit rating agencies the securities and exchange board of India insurance companies and the specialized financial institutions in India.

If you have a 401K program through your employer that is one type of wealth management. Insurance Services Services like issuing of insurance selling policies insurance undertaking and brokerages etc. Financial Regulators In India.

This article throws light upon the eight important financial institutions that operate in India. Some financial organizations provide trust fund Trust Fund A trust fund is a legal entity formed as part of an estate planning tool which holds a grantors assets and duly distributes them to the inheritors after the grantor passes away. Other financial institutions include Export Credit Guarantee Corporation of India ECGC Ltd.

The different types of depository institutions are explained as below. The main depository financial institutions are. The major categories of financial institutions include central banks retail and commercial banks internet banks credit unions savings and loans associations investment banks investment companies brokerage firms insurance companies and mortgage companies.

Mutual fund institutions pool money from public and use the money to buy different types of securities. The major categories of financial institutions include central banks retail and commercial banks internet banks credit unions savings and loans associations investment banks investment. Types of Financial Services.

Investment oriented financial service. The depository institutions collect the saving from different types of savers and provide long-term or short-term loan to the borrower. Capital market Services It consists of consist of term lending institutions which mainly provide long term funds.

1Regulatory institutions Reserve Bank of India RBI Securities and Exchange Board of India SEBI Central Board of Direct Taxes CBDT Central Board of Excise Customs 2Intermediaries. Mutual funds institutions offer a type of investment that multiple parties share in. The financial institutions are.

Banking Services Any small or big service provided by banks like granting a loan depositing money issuing debitcredit cards opening accounts etc. A commercial bank is a financial institution that accepts deposits from the general public and provides loans for investment with the target of earning profit. 8 Trust Fund Services.

Classifications of Financial Institutions Financial Institutions in India are divided in two categories. List of Financial Institutions in India. The financial institutions provide loans and advances to the customers.

Due to commercial banks Commercial Banks A commercial bank refers to a. Citicorp Finance India Limited. Those institutions which provide financial counseling and help by offering loans etc.

The Reserve Bank of India was established in the year 1935 with a view to organize the. Example RBI IRDA SEBI etc. Mutual funds investments are also diversified which helps in reducing risks.

The Insurance Regulatory and Development Authority IRDA does the same for the insurance sector. It also gives a high rated consultancy to the customers for their beneficial investments. Reserve Bank of India RBI conducts the countrys monetary policy.

Return or Income oriented financial service. These include commercial banks savings banks credit unions and savings and loan associations. Two distinctive features of commercial bank are accepting deposits and lending money.

Life Insurance Corporation LIC 5. Commercial banks earn profit by providing loan facilities and earning interest from the loans. Reserve Bank of India 2.

Linking type financial service. The Bank Of Calcutta founded in 1806 and currently known as the State Bank Of India is the countrys oldest profit-oriented bank. There are basically four categories of financial services offered in India.

Are all a part of the Insurance services. Banks ii specialised financial institutions iii investment institutions and iv refinance institutions. Association of Mutual Funds in India AMFI 6.

They manage the clients assets invest them in the best option available in the market. LIC Housing Finance Limited. Example RBI IRDA SEBI etc.

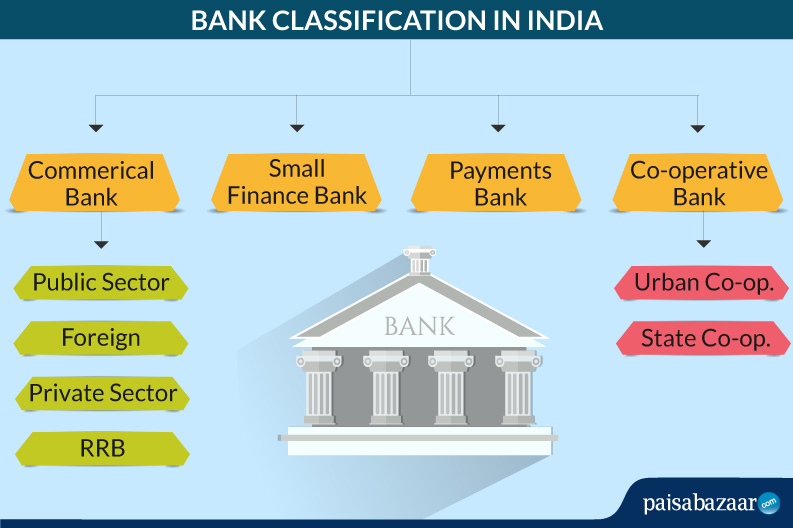

In India there are currently 34 banks with 12 public sector banks and 22 private sector banks. And Deposit Insurance and Credit. Money market Services It consists of commercial banks financial institutions co-operative banks which providing short term funds agencies.

The financial services in India include. 1 DEPOSITORY INSTITUTIONS. Ministry of Corporate Affairs MCA 1.

Trade oriented financial service. 1 Commercial Banks Commercial banks accept deposits from the public and offer security to their customers. Promotion oriented financial service.

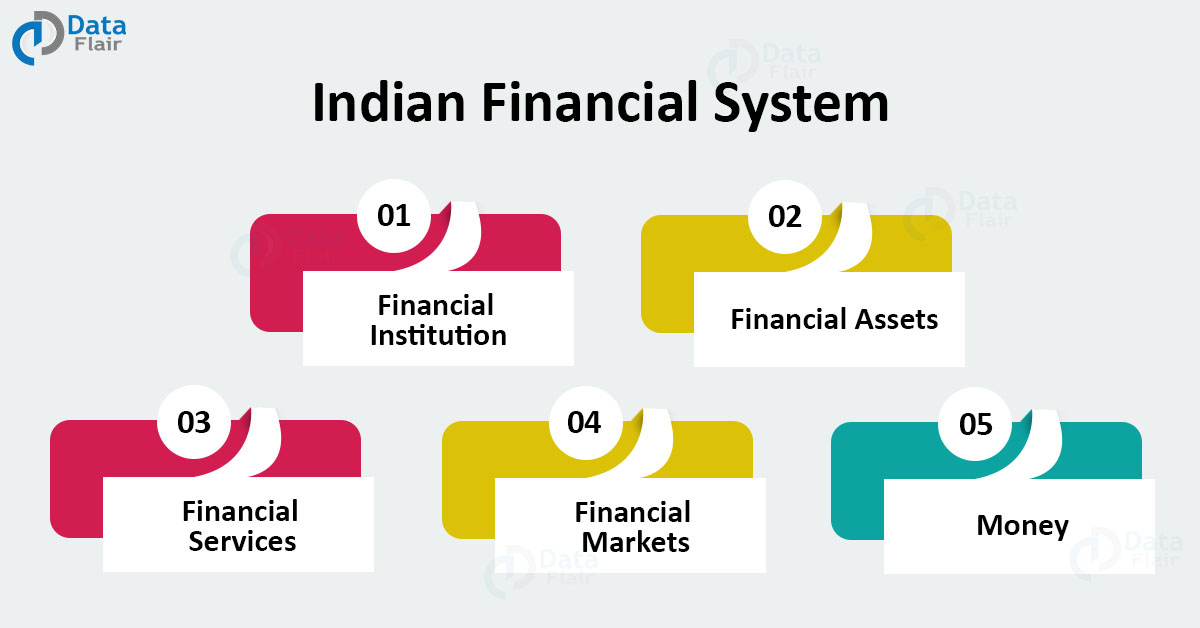

4 Financial Services The services offered by the financial institutions for the management lending borrowing and investment of funds are called financial services. The rate of return is very high in case of investment made in this type of institution. India Infoline Finance Limited.

In India modern banking originated in the late eighteenth century. Those managements and institutions which regulate and overlook the commercial and financial market. Facilitating type financial service.

It also serve as a depository for their customers. A General Banking Services.

Indian Financial System Components And Functions Dataflair

Merchant Banking And Financial Services Unit I Notes For Mba Financial Services Financial Banking

Factoring Types Of Factoring Risk Management Sms Language Financial Institutions

Banking In India Types Of Banks Banking Classification Paisabazaar

Comments

Post a Comment